Published 11/29/17 by Chris Hutchins

What Credit Card Should Be In Your Wallet?

Thanks to points and miles, I’ve been able to travel to dozens of countries around the world for free. Most of those points come from credit cards, so almost every day someone asks me which card they should be using. For a long time the answer was complicated–there were cash back cards, airline/hotel cards and a few cards that had a flexible program like Amex’s Membership Rewards Points. All that changed in 2016…

In August 2016, Chase launched the Chase Sapphire Reserve (CSR), which was like the iPhone launch for miles and points nerds. It quickly became my primary card (and still is) for two main reasons:

- It offers 3x points on Travel and Dining, which are two of the largest spending categories for most people I know.

- It earns Chase’s Ultimate Rewards (UR) points, which can not only be used to transfer to airlines and hotels but also can be redeemed at a very generous cash value.

The only hurdle to get over before signing up is the $450 annual fee. At first glance, it seems high, but Chase refunds your first $300 spent on travel each year. So assuming you spend ≥ $300 on travel, the effective annual fee would be $150, which is definitely in line with most premium rewards and cash back cards (especially when you factor in the other benefits I’ll outline below).

Transferring Points

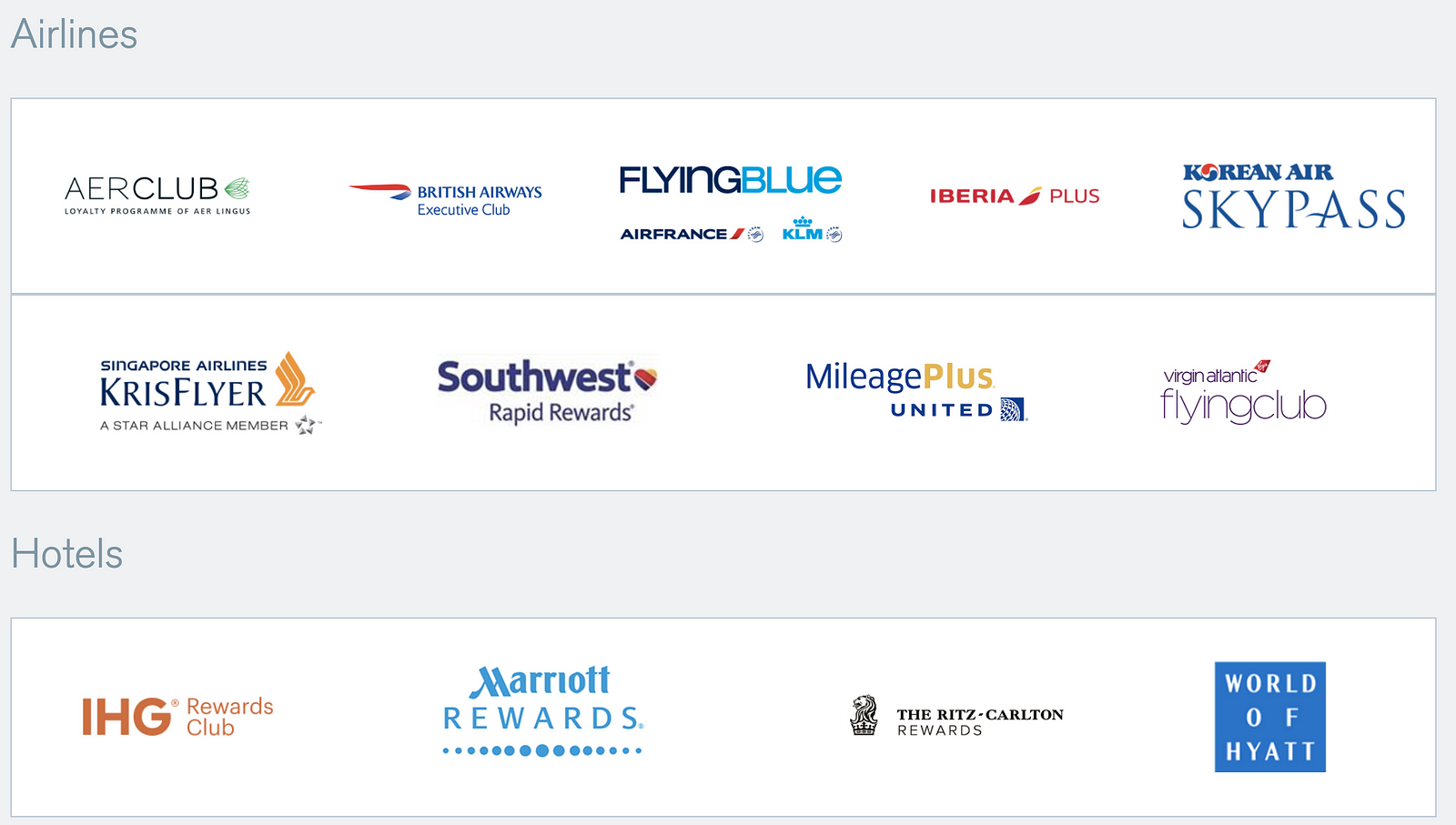

With the CSR, points can be transferred directly to nine different airlines (including at least one in each major alliance) and four different hotel chains. Using your points directly with airlines and hotels can be especially lucrative if you want to travel in business/first class or stay in high end resorts.

International travel is a great example of how transferring points directly to an airline can be so valuable. You might be able to find a $1,500 round-trip from San Francisco to London in economy class, but if you look for business class, you’ll often find the flight costs 5-6x times the price. However, on most airlines the number of miles needed to redeem a business class ticket is usually only double the number you’d need for economy.

So for that same SFO-LHR flight that may cost $8,000 in business class, you could transfer 120,000 points into United, book the flight with miles, and only have to spend~$300 in taxes. While it can take some time or flexibility to find opportunities like this, the reward can be incredible. It’s not uncommon to end up having your points be worth 5–7¢/point — meaning that for travel+dining purchases, you’re effectively earning 15–21% cash back.

It is true that it can be a pain to find availability for flights using miles, so I recommend people check out FlightFox, a paid service to help find award flight availability across many airlines, wherever you want to go. I’ve used them before with great results.

Using UR Points for Cash

Sometimes the flexibility needed to travel using miles/points can be a pain and you want to be able to take a specific flight or stay at a particular hotel. It used to make more sense for people that frequently felt that way to get a cash back card, where they could use the money they earn on any flight or hotel they want.

However, with the CSR, you can book travel through the Chase site and redeem your points for cash towards any flight/hotel you want at a rate of 1.5¢/point. That means that if you’re earning 3x points on travel or dining, you’re getting an effective cash back rate of 4.5%, which is higher than any cash back card I know about.

Other Travel Benefits

In addition to earning and spending points, the CSR comes with a few other great travel benefits that further justify the annual fee:

- Refund of your $100 application fee for Global Entry or TSA Pre✓

- A free Priority Pass membership, which gives you access to >1,000 airport lounges worldwide

- Significant discounts when renting cars with Silvercar, Avis and National

- No foreign transaction fees when using your card abroad

Who the Chase Sapphire Reserve isn’t for…

Despite my belief that the CSR is the best rewards card, it’s not perfect for everyone. Specifically, if the majority of your spending isn’t on travel or dining, you probably have better options. For example, if you spend most of your money on Amazon, the Amazon Prime Rewards Visa earns 5% back on Amazon purchases, or if you spend most of your money on online advertising, the Chase Ink Business Preferred earns 3x points in that category (and happens to have a big 80k point signup bonus right now).

Finally, if your spending is spread out over lots of categories and/or you don’t want to deal with miles or points, you might benefit from a card that just earns cash back on all your purchases. For that, I think the 2% you get with the Citi Double Cash card is hard to beat.

Want to Optimize More?

For many people, having just one credit card is plenty… but what about maximizing your spend outside of travel and dining? I’ve gone deep down this rabbit hole, so stay tuned for a follow-up post where I’ll dig into the top 2–3 cards to pair with the Chase Sapphire Reserve to maximize your earning. If you don’t want to miss the next post, make sure to sign up for my newsletter below.